- Professional Child Care Services

- (561) 562-5482

- (561) 389-7309

- info@joyfuljuneagency.com

Forex Trading Basics Your Comprehensive Guide to Currency Trading

Nahezu 100% Auszahlungsquote Plinko schweiz bietet Nervenkitzel mit bis zu 1000-fachem Einsatz, anpa

October 29, 2025A Comprehensive Guide to Sonabet Your Ultimate Betting Experience

October 29, 2025

Forex Trading Basics: Your Comprehensive Guide to Currency Trading

Forex trading, or foreign exchange trading, is a decentralized global market where currencies are traded. The forex market is one of the largest financial markets in the world, with an average daily trading volume exceeding $6 trillion. For those just starting, the intricacies of currency pairs, pips, leverage, and trading strategies can be overwhelming. This article aims to break down these concepts and provide a clearer understanding of forex trading basics. Whether you’re considering diving into forex trading or simply looking to enhance your knowledge, forex trading basics https://forex-level.com/ is an excellent resource for deeper insights and practical tips.

Understanding Currency Pairs

In forex trading, currencies are traded in pairs. A currency pair consists of two currencies: the base currency and the quote currency. The base currency is the first currency listed in the pair, while the quote currency is the second. For example, in the currency pair EUR/USD, the euro (EUR) is the base currency and the US dollar (USD) is the quote currency. The value of the pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

Currency pairs are categorized into three types:

- Major pairs: These pairs include the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor pairs: These pairs do not involve the US dollar but include other major currencies, like EUR/GBP and AUD/NZD.

- Exotic pairs: These involve a major currency and a currency from a developing country, such as USD/HUF (Hungarian Forint) or USD/TRY (Turkish Lira).

How Forex Trading Works

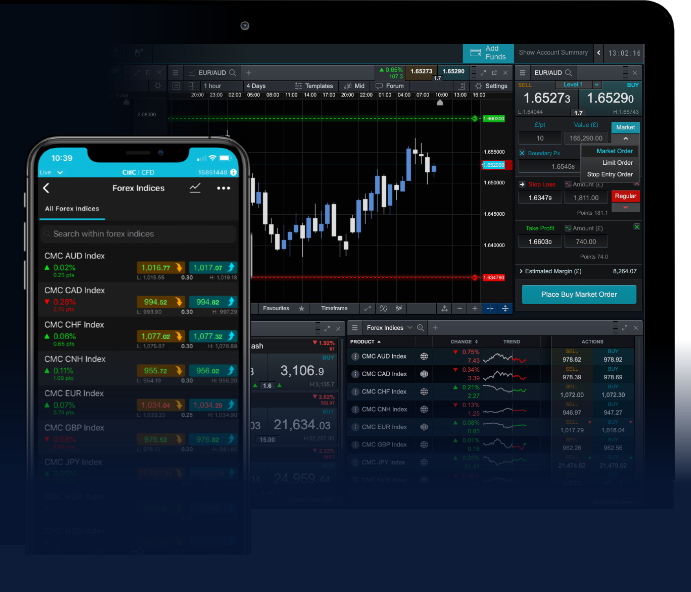

Forex trading takes place over-the-counter (OTC), meaning transactions occur directly between parties, usually through online platforms called forex brokers. When a trader believes a currency will strengthen against another, they will buy that currency pair. Conversely, if they believe it will weaken, they will sell the pair. This is often referred to as going long (buying) or going short (selling).

Trades are executed at the current market price, which fluctuates based on supply and demand, market sentiment, economic indicators, and geopolitical events. The forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time.

Key Terminology in Forex Trading

Understanding key forex terminology is essential for navigating the market. Here are some basic terms that every forex trader should know:

- Pip: A pip is the smallest price move that a given exchange rate can make based on market convention, typically the fourth decimal place for most currency pairs.

- Leverage: Leverage allows traders to control a large position with a small amount of capital. For example, a leverage ratio of 100:1 means that a trader can control $100,000 in the market with just $1,000 of their own capital.

- Spread: The spread is the difference between the bid price (what traders are willing to pay) and the ask price (what traders are willing to sell for).

- Margin: Margin is the amount of money required to open a leveraged position. It is a fraction of the total trade size that must be maintained in your account to keep the position open.

Creating a Trading Plan

A solid trading plan is crucial for success in the forex market. Your trading plan should outline your trading goals, risk tolerance, strategies, and guidelines for entering and exiting trades. Here are some key components of a robust trading plan:

- Set realistic goals: Determine what you want to achieve with forex trading, both in the short term and long term.

- Define your risk tolerance: Establish how much capital you are willing to risk on each trade and ensure it aligns with your overall financial situation.

- Choose a trading strategy: Research and adopt a trading strategy that suits your style, whether it be day trading, swing trading, or trend trading.

- Implement risk management: Use stop-loss and take-profit orders to protect your capital and lock in profits.

Common Forex Trading Strategies

While each trader may develop their unique approach, several common strategies can help guide your trading decisions:

- Scalping: This involves making quick trades to profit from small price movements, typically holding positions for seconds or minutes.

- Day trading: Day traders open and close positions within the same trading day, aiming to profit from short-term market movements.

- Swing trading: Swing traders hold positions for several days to capture price swings, often using technical analysis to identify potential reversal points.

- Position trading: This long-term strategy involves holding trades for weeks, months, or even years, based on fundamental analysis and macroeconomic trends.

Using Technical and Fundamental Analysis

Successful forex trading often requires a combination of technical and fundamental analysis:

- Technical analysis: This involves analyzing price charts and indicators to identify patterns and trends. Common tools include moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels.

- Fundamental analysis: This focuses on economic and political factors that influence currency value, such as interest rates, inflation rates, and political stability. Keeping an eye on economic calendars and news releases can provide insight into market movements.

Final Thoughts on Forex Trading

Forex trading offers numerous opportunities but also comes with risks. It’s essential to educate yourself about currency markets, develop a solid trading plan, and maintain discipline in executing your strategies. Remember to start with a demo account to practice your skills without risking real capital. By understanding the basics of forex trading and continually improving your knowledge, you can navigate the complexities of the forex market and work towards becoming a successful trader.